The Amex SmartEarn Credit Card is designed for individuals seeking a smart balance between affordability and rewarding benefits. This entry-level card from American Express caters to beginners who want to step into the world of premium banking without high annual fees.

It offers accelerated reward points, attractive cashback opportunities, and access to lifestyle privileges, making it suitable for everyday purchases as well as occasional travel. With features like milestone rewards, fee waivers, and exclusive partner offers, this card stands out among other beginner-friendly options. In this review, we will explore its key features, fees, benefits, and how it compares to similar credit cards in the market.

Overview of American Express SmartEarn Credit Card

The American Express SmartEarn Credit Card is designed to make your spending more rewarding. It offers a simple structure where you earn 1 Membership Reward Point for every $50 spent. For specific SmartEarn brand partners (Flipkart, Zomato, Uber, Amazon, Nykaa, Myntra, Ajio, BlinkIt, BookMyShow, EaseMyTrip, PVR) you earn 10X points, making daily purchases more valuable.

It is a great choice if you are searching for the best AmEx card for beginners. Many new cardholders appreciate that it combines affordability with attractive rewards. This SmartEarn credit card review shows it is targeted at young professionals or first-time cardholders who want to build credit while enjoying American Express SmartEarn benefits.

Key Fees and Charges

Every card comes with costs, and here you should focus on the SmartEarn fees and charges. The SmartEarn Credit Card joining fee and renewal fee are set at affordable levels compared to other premium American Express cards. The AmEx joining fee is $495, while renewal is similar unless waived through spending.

Interest rates and charges are important too. The card has standard APR, cash advance charges, and foreign currency markup. Understanding these costs ensures you don’t overspend. Many beginners also look for the SmartEarn annual fee waiver, which can save money if you spend enough each year.

Rewards and Benefits

This card stands out because of AmEx SmartEarn rewards. On normal purchases, you earn steady points. On partner platforms, you gain accelerated reward points that make daily use more profitable. AmEx SmartEarn movie and dining offers include 10X points on Zomato, BookMyShow, and PVR, which attract entertainment lovers.

The overall value lies in flexibility. You can combine everyday spending with bonuses on partners like Amazon, where you get SmartEarn credit card Amazon 5X rewards. While there is a monthly cap, this card still provides a strong return for those who shop and dine frequently.

Welcome and Milestone Benefits

The SmartEarn welcome benefits give new users an extra push. You receive $500 cashback if you spend $10,000 within the first 90 days. Eligible purchases exclude balance transfers, cash advances, and fees. This is a generous way to start your journey.

The milestone benefits SmartEarn program also helps you save. Spend $40,000 in a membership year, and you receive the AmEx SmartEarn annual fee waiver Rs 40,000 spend. Reaching higher spend levels unlocks extra vouchers from brands like Amazon, Flipkart, or Myntra. This system rewards loyalty while controlling costs.

Reward Redemption Process

The American Express reward redemption program is flexible. You can pay your bill with the AmEx Cash + Points scheme, use e-vouchers, or shop with American Express shopping vouchers. Many U.S. cardholders enjoy choosing travel or retail rewards.

For frequent travelers, the AmEx SmartEarn rewards redemption process includes transferring points to airlines and hotels. Programs like Asia Miles, British Airways, Hilton Honors, and Marriott Bonvoy are available. Knowing how to redeem Membership Reward Points AmEx SmartEarn is crucial because it maximizes your savings.

Lounge Access and Travel Privileges

Unlike premium cards, this one has limited credit card lounge access. Domestic and international lounge entry is not standard here, which can be a drawback. Still, you benefit from AmEx travel offers like Uber credits and discounts on select travel portals.

The AmEx SmartEarn travel and lounge benefits may not compete with Platinum cards, but they still serve casual travelers. Occasional flyers can use their earned points for flights or hotel stays, making it a balanced card for beginners.

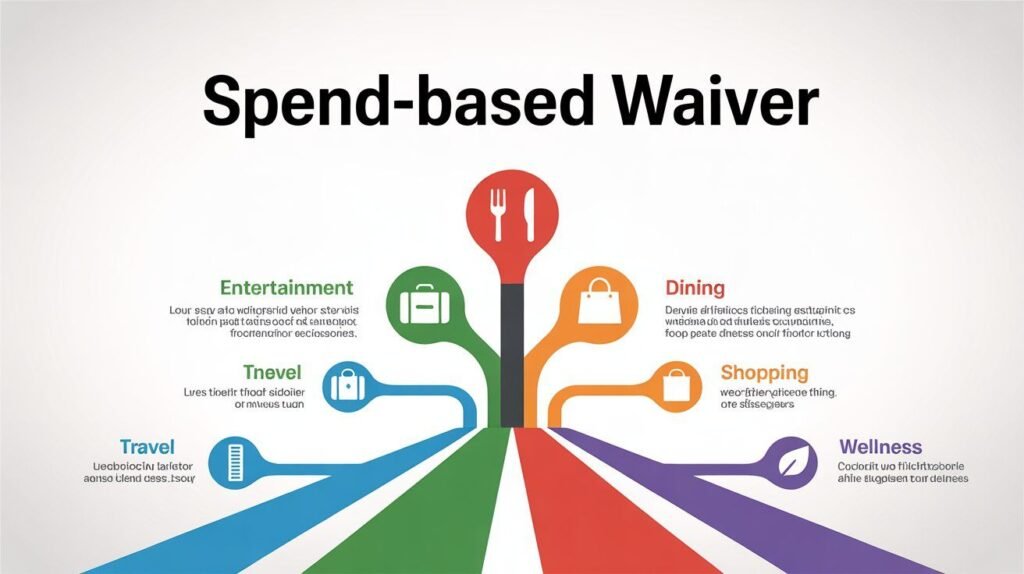

Spend-Based Waiver and Offers

The card offers an AmEx spend-based waiver if you cross the $40,000 annual spend mark. This means you avoid renewal charges while enjoying perks. Many users find this achievable since it matches typical yearly expenses for middle-income professionals.

Seasonal deals also add to the appeal. You may see shopping or dining promotions during festive sales. To understand savings better, check the table below:

| Annual Spend | Benefit |

|---|---|

| $40,000 | Annual Fee Waiver |

| $120,000 | $500 Voucher |

| $180,000 | Additional $500 Voucher |

| $240,000 | Total $1,500 Vouchers |

Pros and Cons of SmartEarn Credit Card

Every SmartEarn credit card review must weigh positives and negatives. The advantages include AmEx SmartEarn rewards, easy eligibility, and the chance to earn vouchers from popular brands. The entry-level AmEx card status makes it friendly for first-time users.

On the downside, reward caps can frustrate heavy spenders. The limited AmEx SmartEarn travel and lounge benefits mean frequent flyers might prefer another product. Some critics argue the maximum reward points in AmEx SmartEarn card are too low for high-value transactions.

Final Review and Expert Opinion

So, American Express SmartEarn vs other entry-level cards—which is better? This card shines in its mix of affordability and rewards. It is best for beginners who want the American Express SmartEarn benefits without heavy fees.

If you want a balance of brand prestige and everyday savings, this card is a solid choice. Experts agree that while not luxurious, it is a dependable step into the AmEx world. For many users, the AmEx SmartEarn review 2025 shows it as a smart pick for building credit history and enjoying steady perks.

FAQs

What is the credit limit for Amex Smart Earn credit card?

The Amex SmartEarn Credit Card has no fixed limit; it depends on your income, credit score, and Amex’s internal assessment.

What is the American Express SmartEarn credit card?

The American Express SmartEarn Credit Card is an entry-level rewards card that lets you earn Membership Rewards points on everyday and online spends.

How much is the annual fee for an Amex credit card?

The annual fee for the Amex SmartEarn credit card is ₹495 + taxes.

How much credit card limit for 30,000 salary?

If your monthly salary is PKR 30,000, a rough estimate for a credit card limit could be around 2× to 3× your salary, so somewhere between PKR 60,000 and PKR 90,000.

I am a passionate blogger, researcher, and author creating insightful content that inspires learning and creativity. I also accept guest posts and link insertions.